What is my tax rebate?

It’s the money you can claim back from the government for the donations you’ve given over a tax year. You claim 1/3 of your donations back for each donation over $5.

How do I donate my tax rebate to UNICEF?

1. The fastest way is to file your tax return online via your myIR account, that way you'll receive your refund sooner.

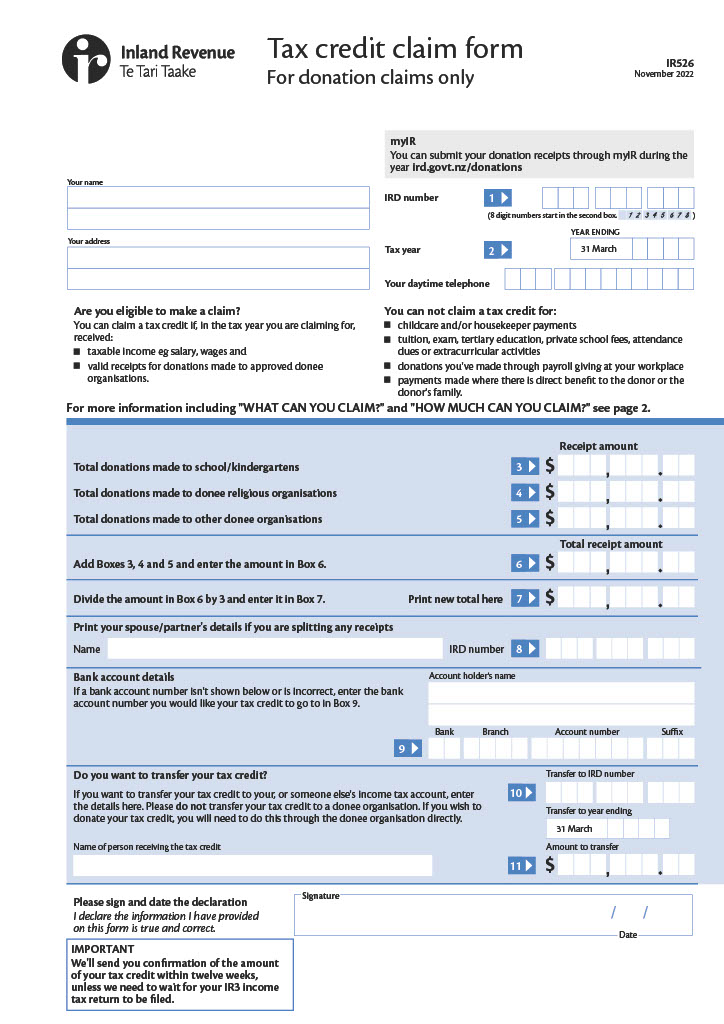

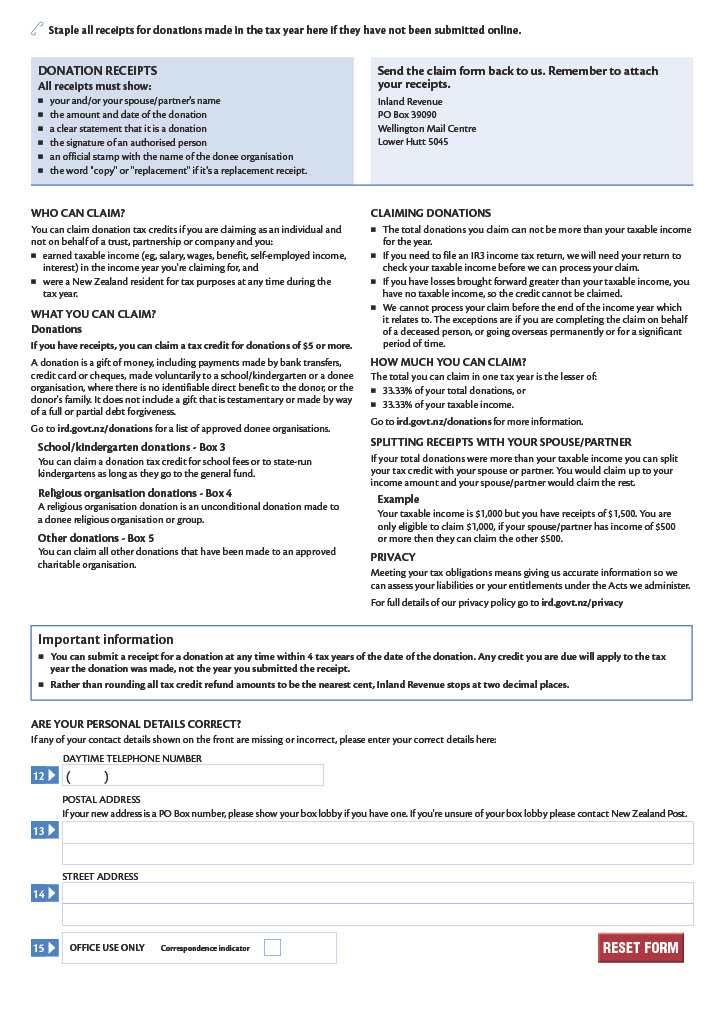

Alternatively, you can complete this IRD 526 form with your details, attach your donation receipts and mail them to Inland Revenue.

For more info visit ird.govt.nz/donations.

2. Upload photos, scans, or electronic copies of your receipts to your myIR account. Make sure your receipts include the following information:

- Your name

- the amount you donated

- the date you donated

- a clear statement that it was a donation

- UNICEF’s name and IRD number

- UNICEF’s official stamp or letterhead, and signature

- UNICEF’s charity number

Or, if filing via postal mail, attach your 2023/2024 tax receipts to the IR 526 form and return it to:

Inland Revenue Department

PO Box 39090

Wellington Mail Centre

Lower Hutt 5045

3. Once you receive your tax rebate into your bank account, you can gift it to UNICEF in one of two ways:

1. Through online banking (see our details below)

Account Number 01-0505-0463764-00

Account Name UNICEF NZ

Particulars Your Name

Code Donor ID number (if known)

Reference Tax rebate

If you do not know your donor ID number, please check the footer of any recent emails you've received from us. If you still can't find, please email support@unicef.org.nz to let us know your name, address and the amount after you've made the deposit.

2. By calling us on 0800 243 575 to donate via credit card over the phone

By donating your tax rebate to UNICEF NZ you are helping us reach even more children in need